How Animals Danger Defense (LRP) Insurance Coverage Can Secure Your Animals Investment

Animals Danger Security (LRP) insurance coverage stands as a reliable guard against the unpredictable nature of the market, using a calculated approach to safeguarding your assets. By diving right into the complexities of LRP insurance and its complex benefits, livestock manufacturers can strengthen their financial investments with a layer of safety and security that goes beyond market fluctuations.

Comprehending Animals Threat Security (LRP) Insurance Coverage

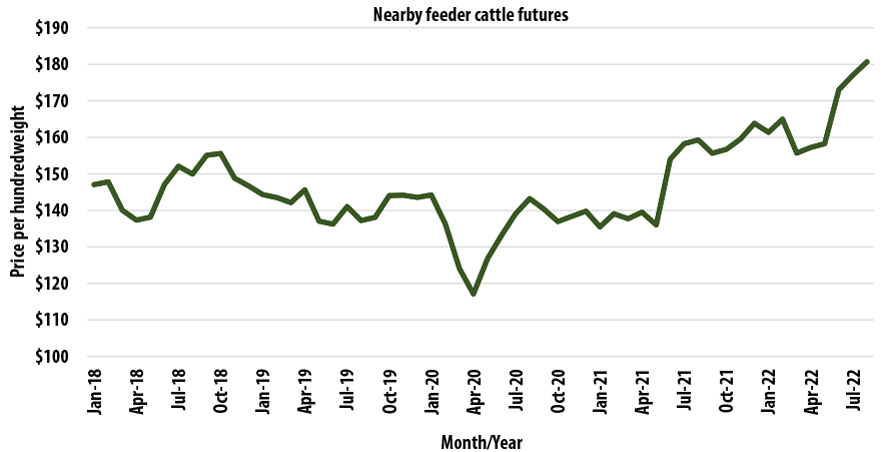

Comprehending Livestock Risk Security (LRP) Insurance policy is important for animals producers looking to mitigate monetary threats connected with price changes. LRP is a government subsidized insurance policy product designed to shield manufacturers versus a drop in market value. By offering coverage for market cost declines, LRP assists manufacturers secure a floor price for their livestock, making certain a minimum level of earnings no matter market variations.

One trick element of LRP is its versatility, permitting manufacturers to tailor protection levels and policy lengths to match their details needs. Producers can select the variety of head, weight variety, insurance coverage price, and protection duration that line up with their production goals and run the risk of tolerance. Understanding these personalized choices is important for producers to effectively manage their cost risk exposure.

Furthermore, LRP is readily available for numerous animals types, consisting of cattle, swine, and lamb, making it a versatile danger monitoring tool for animals manufacturers throughout various industries. Bagley Risk Management. By acquainting themselves with the intricacies of LRP, manufacturers can make educated choices to safeguard their financial investments and make sure economic security in the face of market uncertainties

Advantages of LRP Insurance Policy for Animals Producers

Livestock producers leveraging Animals Threat Defense (LRP) Insurance policy obtain a strategic advantage in securing their financial investments from rate volatility and protecting a secure monetary ground amidst market unpredictabilities. One essential advantage of LRP Insurance is cost defense. By setting a floor on the rate of their animals, producers can reduce the risk of significant financial losses in case of market recessions. This enables them to plan their budget plans better and make notified decisions regarding their procedures without the consistent concern of cost changes.

Furthermore, LRP Insurance supplies manufacturers with satisfaction. Recognizing that their investments are secured versus unexpected market adjustments allows manufacturers to concentrate on various other elements of their organization, such as enhancing pet health and wellness and well-being or optimizing manufacturing procedures. This comfort can lead to increased efficiency and success over time, as manufacturers can operate with more self-confidence and security. Generally, the advantages of LRP Insurance policy for animals producers are significant, offering an important tool for managing risk and making certain economic security in an unpredictable market setting.

Exactly How LRP Insurance Mitigates Market Risks

Reducing market threats, Livestock Threat Security (LRP) Insurance provides animals producers with a reliable shield against cost volatility and financial unpredictabilities. By providing protection versus unexpected cost drops, LRP Insurance coverage assists producers secure their financial investments and preserve economic stability despite market fluctuations. This kind of insurance policy permits livestock producers to secure a price for their pets at the beginning of the plan duration, making certain a minimum cost level no matter of market adjustments.

Steps to Secure Your Livestock Financial Investment With LRP

In the world of farming threat management, implementing Livestock Danger Defense (LRP) Insurance coverage entails a critical process to secure financial investments versus market changes and uncertainties. To protect your animals investment effectively with LRP, the primary step is to assess the details threats your operation faces, such as cost volatility or unanticipated climate occasions. Understanding these risks allows you to figure out the coverage level required to protect your investment properly. Next, it is vital to research study and select a reputable insurance company that uses LRP plans tailored to your animals and organization requirements. Carefully assess the policy terms, conditions, and insurance coverage restrictions to ensure they align with your danger management goals as soon as you have chosen a supplier. Furthermore, routinely monitoring market patterns and changing your coverage as needed can aid enhance your defense against potential losses. By complying with these steps carefully, you can improve the security of your livestock investment and navigate market uncertainties with self-confidence.

Long-Term Financial Security With LRP Insurance

Making certain withstanding monetary security via the application of Animals Danger Security (LRP) Insurance is a sensible long-term method for agricultural producers. By incorporating LRP Insurance coverage right into their danger monitoring strategies, farmers can guard their livestock investments versus unforeseen market variations and damaging occasions that might threaten their financial health in time.

One key advantage of LRP Insurance policy for long-term monetary safety is the peace of mind it offers. With a trustworthy insurance plan in location, farmers can reduce the financial useful link risks connected with unpredictable market conditions and unanticipated losses as a result of aspects such as disease outbreaks or all-natural catastrophes - Bagley Risk Management. This stability allows producers to concentrate on the daily operations of their livestock organization without continuous bother with possible monetary setbacks

Furthermore, LRP Insurance policy supplies an organized strategy to managing risk over the long-term. By establishing details coverage levels and picking ideal recommendation periods, farmers can customize their insurance coverage plans to straighten with their monetary goals and take the chance of tolerance, making sure a safe and lasting future for their animals operations. Finally, buying LRP Insurance coverage is an aggressive method for farming producers to accomplish long lasting monetary safety and safeguard their source of incomes.

Final Thought

Finally, Livestock Risk Defense (LRP) Insurance is an important device for animals producers to alleviate market threats and secure their investments. By recognizing the advantages of LRP insurance and taking actions to implement it, producers can achieve long-term monetary protection for their look at here now procedures. LRP insurance coverage gives a safety and security internet against price changes and makes sure a level of security in an unforeseeable market setting. It is a sensible option for guarding animals investments.